Car Insurance Pricing Index

Insuring Your Vehicle

Car insurance costs depend on a combination of factors. Insurers will look at various components including, your age, the type of vehicle you are looking to insure, your current job title, your claims history, eircode, annual mileage, and any additions you may choose to make to your car. By comparing quotes from 14 different insurers, we always make sure to find the best value insurance for you.

Taking all of this into account, we've created the ultimate pricing index for car insurance in 2025 to help you compare insurance premiums based on the make and model of your car, what county you live in, your occupation, as well as several other factors.

Contents

- Average Car Insurance Price by Province

- Average Car Insurance Price by County

- Average Car Insurance Prices by Age

- Car Insurance Costs for New Drivers

- Average Prices for the Top 10 Most Popular Models

- The Cheapest Car Brands to Insure in Ireland

- The 10 Cheapest Electric Vehicles to Insure in Ireland

- The Occupations with the Lowest Car Insurance

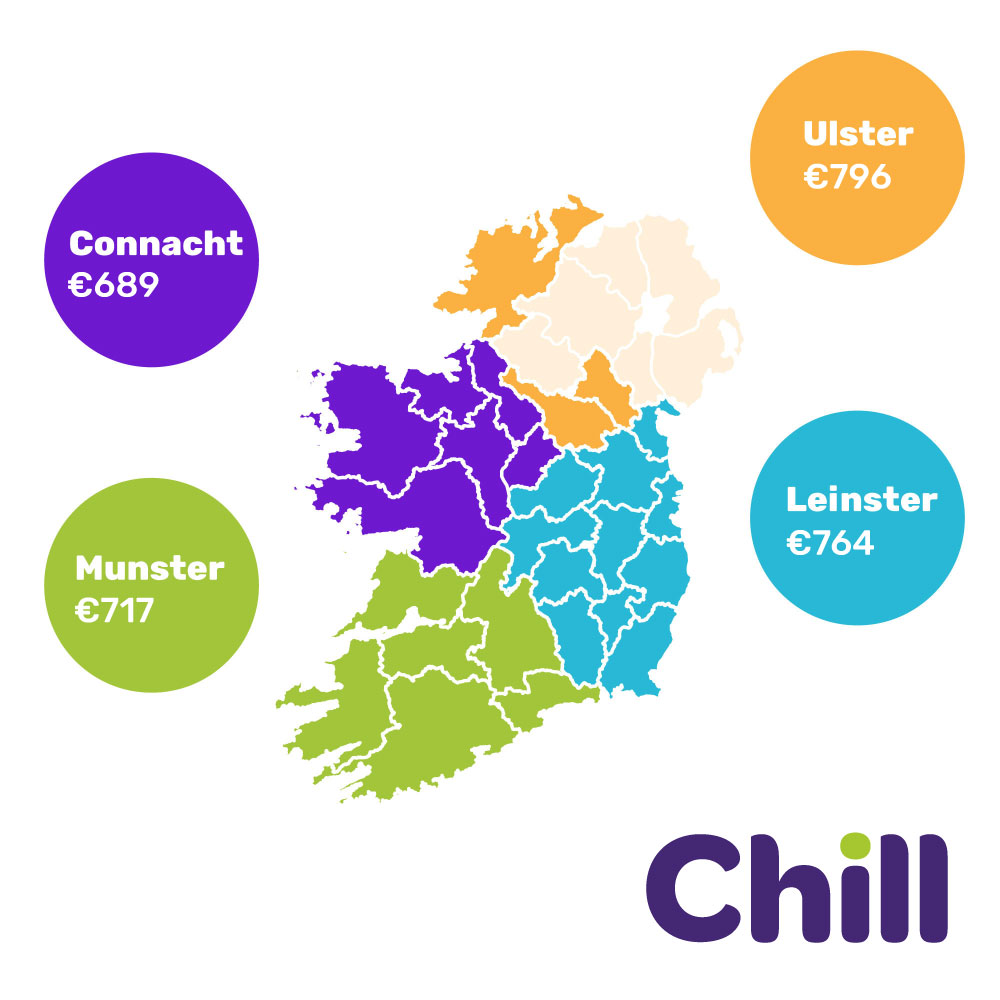

Average Car Insurance Price by Province

Living in an area with elevated crime rates and dense traffic can substantially increase your car insurance costs. Your home location is a key factor in how insurers calculate your premium. This is evident in Ireland, where certain rural counties command higher insurance rates due to a history of more frequent claims, despite their countryside setting.

Amongs the four provinces of Ireland, Connacht has the lowest average premium price at an average of €689, and Ulster is the most expensive with an average of €796. Leinster is second most expensive with an average premium of €764, while Munster comes in third with an average of €717.

Average Car Insurance Price by County

| County | Avg. Price | New rank (Mar ‘25) |

Old rank (Mar ‘24) |

Change |

|---|---|---|---|---|

| Kilkenny | €629 | 1 | 1 | 0 |

| Waterford | €643 | 2 | 2 | 0 |

| Leitrim | €596 | 3 | 3 | 0 |

| Cork | €644 | 4 | 6 | 2 |

| Wicklow | €661 | 5 | 5 | 0 |

| Mayo | €671 | 6 | 11 | 5 |

| Sligo | €688 | 7 | 8 | 1 |

| Wexford | €691 | 8 | 4 | -4 |

| Kerry | €709 | 9 | 10 | 1 |

| Galway | €711 | 10 | 12 | 2 |

| Laois | €712 | 11 | 17 | 6 |

| Donegal | €726 | 12 | 13 | 1 |

| Clare | €730 | 13 | 14 | 1 |

| Roscommon | €731 | 14 | 9 | -5 |

| Carlow | €736 | 15 | 15 | 0 |

| Tipperary | €739 | 16 | 21 | 5 |

| Offaly | €744 | 17 | 7 | -10 |

| Kildare | €757 | 18 | 16 | -2 |

| Westmeath | €768 | 19 | 18 | -1 |

| Dublin | €772 | 20 | 19 | -1 |

| Meath | €785 | 21 | 22 | 1 |

| Cavan | €829 | 22 | 20 | -2 |

| Monaghan | €833 | 23 | 23 | 0 |

| Limerick | €838 | 24 | 25 | 1 |

| Louth | €873 | 25 | 24 | -1 |

| Longford | €1,042 | 26 | 26 | 0 |

County Mayo has seen the biggest drop in price

Last year, Mayo was the 11th most expensive county for car insurance, however as of March 2025, it has shot up to sixth place and now the average cost is €671. Laois and Tipperary have also seen significant drops in price this year, rising up six and five places respectively.

County Offaly has seen the biggest price increase, dropping 10 places to seventeenth with an average cost of €744.

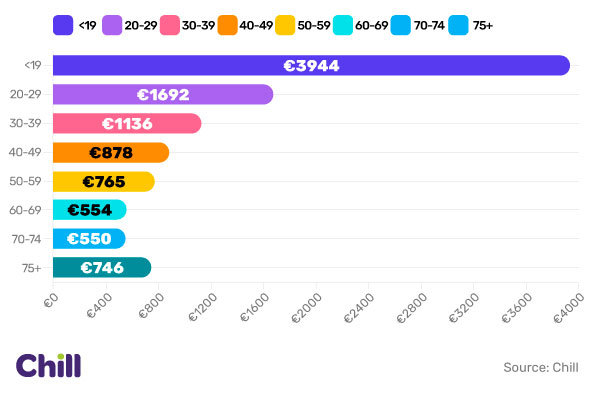

Average Car Insurance Prices by Age

The cost of car insurance typically varies depending on your age. This is because the cost is primarily based on risk. The ‘riskier’ you are to insure, the more expensive your car insurance policy is likely to be.

Younger drivers, from the age of 17–29, typically pay more for their premiums than older drivers, making them the ‘riskiest’ age group on the road. This stems from the fact that young drivers haven’t had the opportunity to gain as much experience on the roads.

While insurance for drivers under the age of 19 remains high (€1,884), typically insuring a driver between the age of 20–29 will cost around €1,692 per annum. However, there are ways to lower these insurance costs - you may choose to add an experienced driver with a good driving history to your policy, or it could be beneficial to choose a car from a lower insurance group to help make your policy cheaper (we will discuss more on this later).

However, it's crucial to note that insurance costs tend to be higher for all novice drivers, regardless of age. Insurers view inexperienced drivers as higher risk, and these individuals rarely have established no-claims discounts to offset their premiums.

Typically, motorists aged over 70 enjoy lower car insurance rates compared to younger drivers, benefiting from their extensive driving experience and accumulated time on the road. Their often substantial no-claims discount history contributes significantly to their access to some of the market's most competitive premiums.

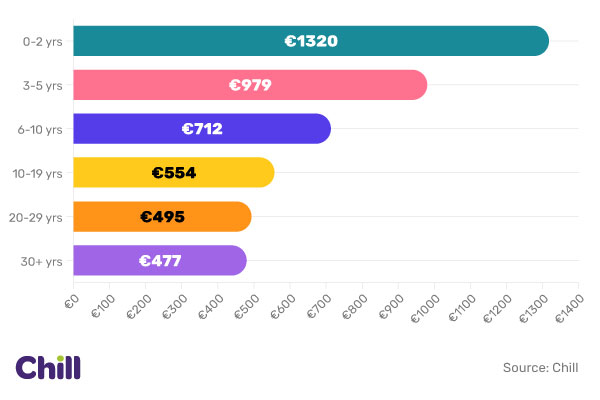

Car Insurance Costs for New Drivers

Insurance costs reduce by around 27% after three years of holding a licence.

Experience is one of the biggest factors when it comes to car insurance premiums. The longer you’ve been driving, the lower your insurance costs will be (provided you have not made any claims).

Insurance Prices for the Top 10 Most Popular Models

Of the most popular car models the cheapest on average to insure in Ireland are the KIA Sportage, Hyundai Tucson and the Skoda Octavia.

The Cheapest Car Brands to Insure in Ireland

Our findings highlight that Dacia comes in as the cheapest out of all car brands analysed to insure - this is likely because they only sell a limited number of models which generally appeal to the older demographic.

Insurance is one of the biggest annual motoring costs and your choice of car actually plays a huge part in keeping your car insurance cheap. Insurance providers may consider the following:

- The size of the car

- The cars value - how much it is worth?

- The age of your vehicle

- What safety equipment it's fitted with

- What security features it has

- How susceptible it will be to accidental damage

- How much it will cost to repair and how long it would take

- It is important to keep in mind that any modifications to a car can affect its insurance premiums significantly too.

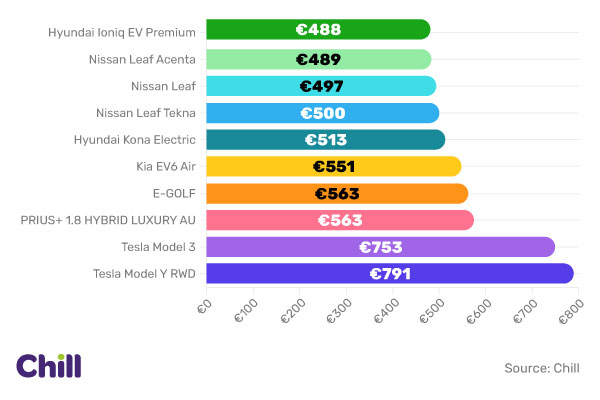

The 10 Cheapest Electric Vehicles to Insure in Ireland

Electric Vehicles continue to rise in popularity with the increase in availability of charging stations. But, which electric vehicles on the market are the cheapest to insure?

The Occupations with the Lowest Car Insurance

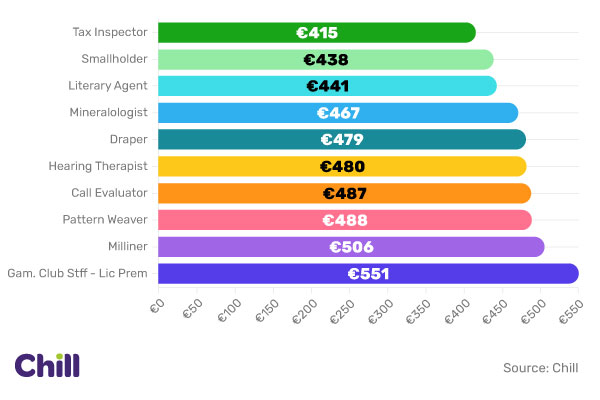

Believe it or not, your occupation actually plays a vital role in the price of your car insurance. Our data reveals that tax inspectors come in with the cheapest car insurance at an average premium of €415.

Your occupation is used by insurance companies as a risk indicator and it can be viewed by different companies in different ways. People who work in an office or are considered remote workers may drive less frequently, or have shorter commutes. This means that they are seen as a lower risk to insurance companies and are therefore more likely to receive a lower premium.

Experience on the road is also a major determining factor for your insurance premium. Jobs that are populated by an older demographic will result in a lower insurance premium. A stable work schedule and driving environment can also reduce the cost of your insurance.

Methodology

Average prices are shown from new business and renewal sales between April 2024 – March 2025, including any fees. We then repeated this for the previous 12 months to allow a comparison. For the occupation insurance prices we only used roles that had 50 or more quotes to obtain a clear average.