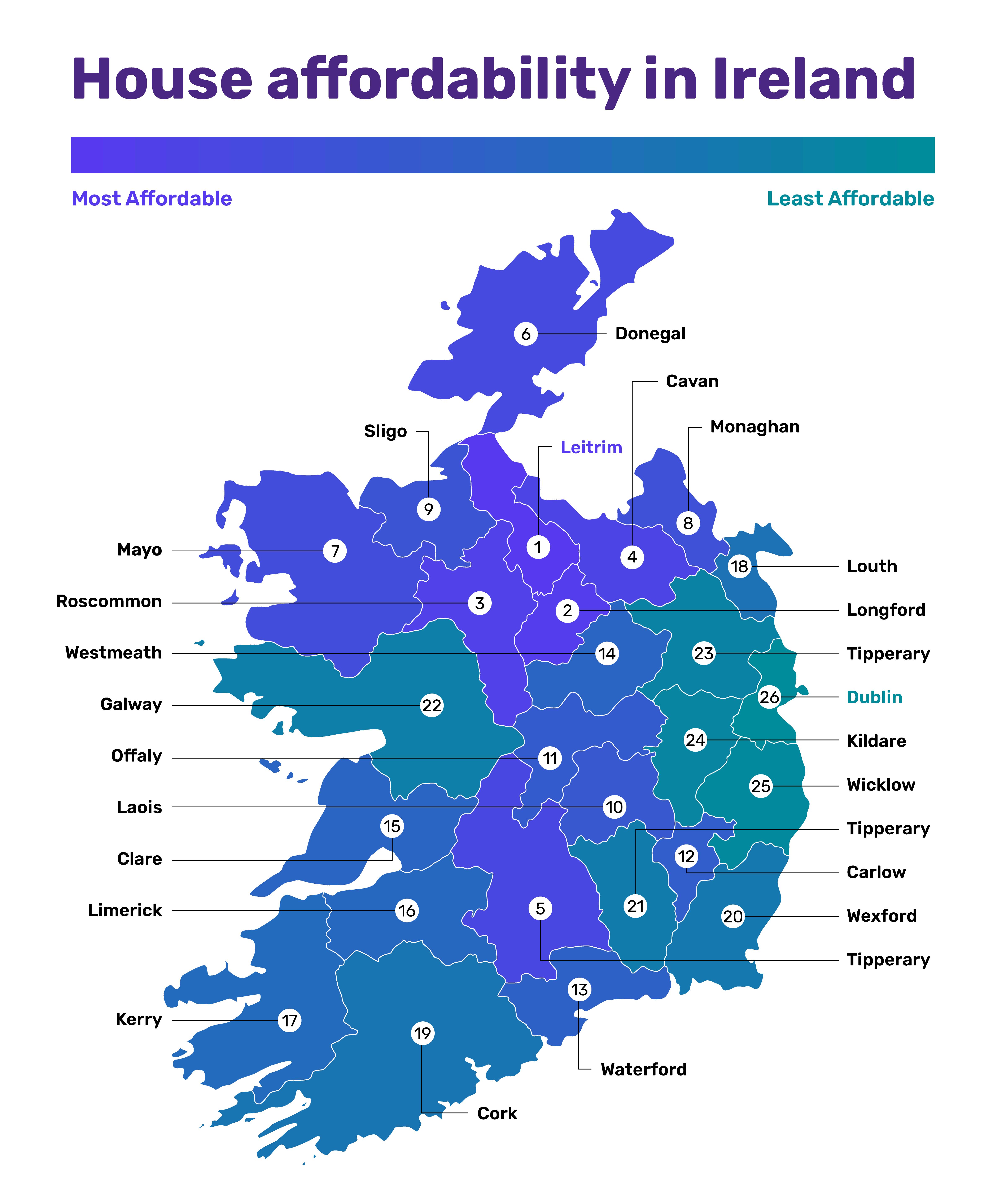

The Counties With The Most Affordable Homes

Our latest research reveals the most and least affordable counties for purchasing homes in Ireland.

Your house is likely the largest financial investment you’ll ever make, but it’s more than just the numbers - it's about finding a space you can truly call home. However, amidst Ireland’s ongoing housing crisis, residents are seeing a decreased supply of homes and a drastic surge in prices making the dream of homeownership seem increasingly unattainable.

Despite these challenges, some counties in Ireland stand out as offering more affordable housing options, putting the property ladder within reach for prospective buyers, without sacrificing their financial security. But which counties offer the most affordability and where do properties cost the most?

To find out, here at Chill Insurance, we analysed housing data from 2010 to 2024 across all Irish counties, considering average house prices, incomes, and key financial metrics. Our research included calculating the minimum house deposit (10% of the purchase price), annual savings rates (12.7% of income), the time needed to save for a deposit, and projections for house prices through 2030. Using this data, we identified the most and least affordable counties, ranking them by 2024 average house prices. Additionally, future projections were ranked to highlight counties expected to experience the largest price increases.

Most affordable Irish counties to buy a home

Through analysing 2024 data and ranking the counties by average house price, we have been able to determine which have the lowest average prices and are therefore the most affordable.

1. County Leitrim

County Leitrim, Ireland’s least populated county, takes the title of the most affordable place to buy a home. In 2024, the average home in Leitrim sold for €186,487, requiring a minimum deposit of €18,649 - a figure significantly below the national average of €29,108. This affordability makes Leitrim an attractive option for those with a smaller budget - including first-time buyers. Towns like Carrick-on-Shannon provide a perfect blend of modern amenities and countryside tranquility, further enhancing this county’s appeal.

Despite average income in County Leitrim being slightly below the national average, sitting at €38,829 per year, saving for a home here is still relatively achievable. Prospective buyers, saving at the national average rate of 12.7% of their income (approximately €5,000 annually), could accumulate the necessary deposit in 3 years and 9 months. This not only makes Leitrim the most affordable but also the most accessible destination for homeownership.

2. County Longford

County Longford secures second place as one of Ireland’s most affordable counties for housing. Beyond its affordability, Longford boasts a central location with excellent connectivity via major transport links, making it an ideal base for accessing nearby counties and the capital. This strategic positioning, combined with an average house price of €192,682, makes Longford an appealing choice for prospective homeowners.

While Longford has one of the lower average annual incomes of €38,515, saving for a deposit here remains relatively achievable. Residents can typically accumulate the required amount in just under four years - a significantly shorter timeframe compared to other counties, where saving periods can stretch anywhere from four to eight years.

3. County Donegal

County Donegal, home to historic sites such as Glenveagh National Park and Donegal castle might seem out of reach to many prospective buyers. However, Donegal is Ireland’s third most affordable county, with an average house price of €199,332.

With an average annual income of €35,289, residents of Donegal can expect to save approximately €4,482 per year. This means prospective buyers should be able to accumulate the €19,933 deposit required for a home in approximately 4 years and 5 months. Combining affordability with a welcoming charm, Donegal is an excellent choice for families and individuals seeking to enjoy an enriching lifestyle without stretching their budgets.

Least affordable Irish counties to buy a home

By ranking the counties by 2024 average house price, we have also been able to reveal which have the highest average prices and are therefore the least affordable.

1. County Dublin

It comes as little surprise that County Dublin, home to the nation's capital, is Ireland’s least affordable location for prospective homeowners. With the average home price in 2024 standing at a staggering €614,012, Dublin’s property market is a reflection of its status as the cultural and economic heart of Ireland. Boasting a vibrant job market and bustling lifestyle, the demand for housing has set prices sky-high.

However, the allure of living in County Dublin comes with a hefty price tag that may not be justifiable for many. While average incomes in this county are significantly higher than the national average at €55,326 saving for a deposit remains a daunting task. Residents would need nearly nine years to save the substantial €61,401 deposit that is typically required - a task that becomes even more difficult for those looking to move to Dublin from another county with lower average income.

2. County Wicklow

Nicknamed the “Garden of Ireland”, County Wicklow ranks as the second least affordable place to buy a home. With average property prices at €461,534, this scenic county’s breathtaking landscapes, from Glendalough to the Wicklow Mountains, come with a premium price tag.

Wicklow’s proximity to Dublin makes it a sought-after location for commuters seeking a balance between working in the city and a more tranquil home life. However, this convenient balance has inflated property values. Whilst the average resident is expected to save a steady €6,340 per year, it would still take an incredibly long 7 years and 3 months to save for a deposit here which exceeds €45,000.

3. County Kildare

County Kildare, ranking as Ireland’s third least affordable county, offers a unique blend of rural charm and urban convenience with excellent transport links. House prices in this county have averaged at €406,165 this year, meaning the average deposit stands at €40,616. For residents earning an average annual income of €50,143, it would take approximately 6 years and 5 months of disciplined saving to accumulate the required deposit. While this timeframe is shorter than that of Wicklow or Dublin, the financial commitment remains steep.

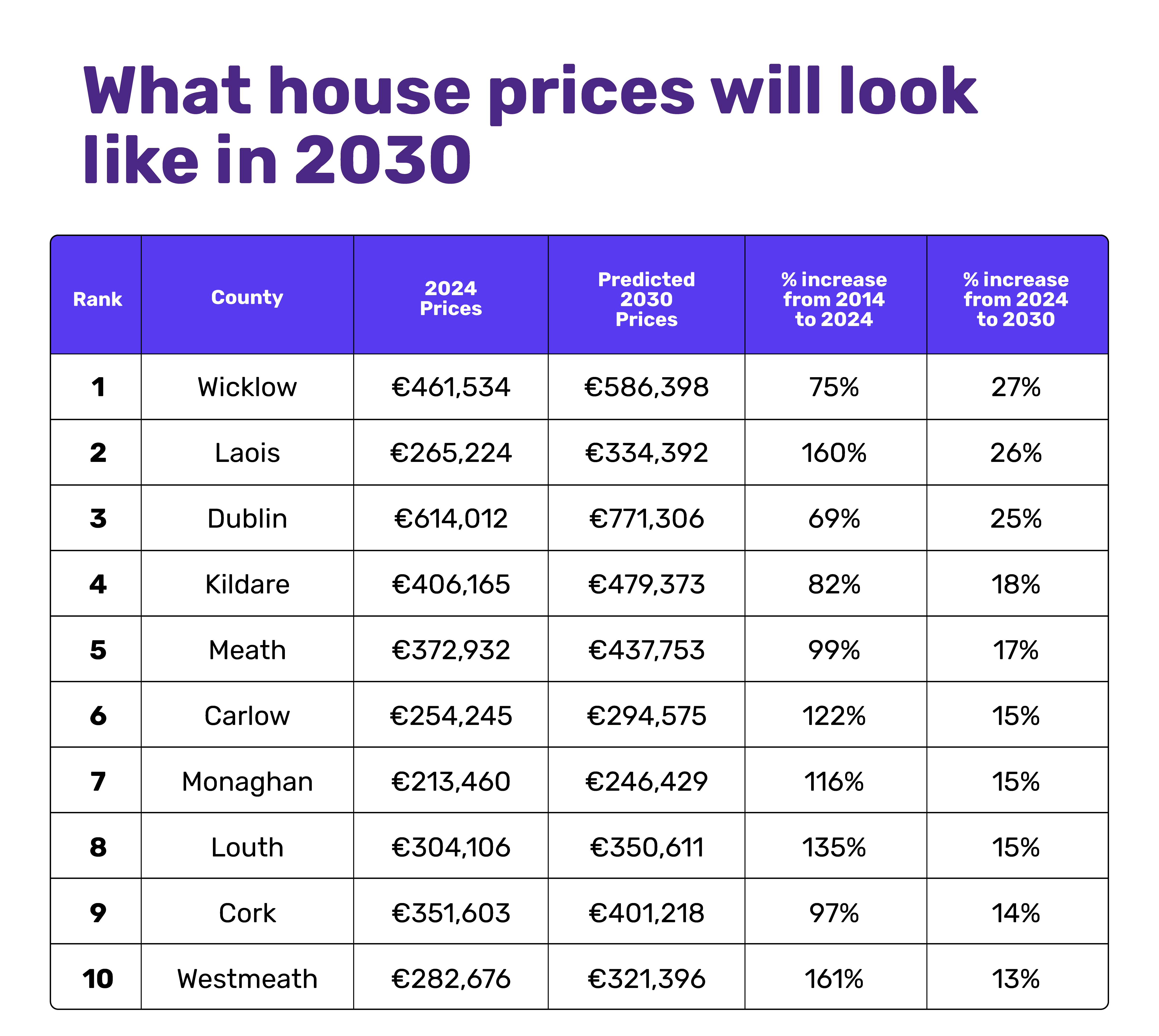

What house prices will look like in 2030

To gain insight into how house prices in Ireland may evolve in the coming years, we utilised predictive formulas alongside average house price data dating back to 2010 to forecast trends through 2030. To identify which counties are likely to experience the most significant growth, we calculated the percentage change in house prices between 2024 and 2030.

County Wicklow is projected to see the steepest rise in house prices by 2023, climbing from €461,534 to €586,398 over the next half-decade - a 27% surge. This significant growth could make the county even less attainable for potential buyers. However, for current homeowners looking to relocate, this trend could bring welcome financial benefits. However, it is Laois that has seen the largest increase over the last 10 years, jumping from an average of €101,752 to €265,224, a difference of 161%.

Both Dublin and Kildare rank in the top five for the largest price increases too, increasing by 26% and 18% respectively. In 2030, the average home in Dublin is expected to cost over three-quarters of a million euros (€771,306), whilst property prices in Kildare settle at a slightly more manageable €479,373. Although these counties are set to experience significant growth in housing costs, the projected increases are notably lower than the dramatic surges of the past decade, which saw prices soar by 70% in Dublin and 82% in Kildare.

The good news is that the more affordable counties such as County Longford, County Roscommon, and County Donegal are predicted to have much more marginal increases. Prices in Longford are projected a slightly steeper increase at a predicted rate of 9.75% meaning house prices will sit at €211,469 compared to the current €192,682. Prices in Donegal are set to increase by just 3.13% to €205,575.90.

Despite high price increases of 181% in the last decade, house prices in Roscommon are expected to rise by as little as 0.72% meaning those who are beginning to save for a home now can expect similar prices when they have completed their savings in around three years. Sligo is the only county expected to see house prices drop by 2030.

Expert advice when saving for a house deposit

Ian O’Reilly from Chill Insurance shares tips for buying a home :

“Saving for a deposit can feel daunting, especially when facing the prospect of spending up to eight years accumulating funds. While skipping your morning latte or avocado toast won’t singlehandedly get you onto the property ladder, smarter saving habits can make a big difference. Experts recommend following the 50/30/20 rule: allocate 50% of your income to necessities, 30% to personal wants, and 20% to savings. This approach is 7% higher than the national average savings rate, giving you a crucial reduction in the time it will take to accumulate your deposit.

“Consulting a mortgage advisor is another valuable step. They can help you understand what you can afford and potentially secure better mortgage deals, saving you money in the long run.

“Additionally, government help-to-buy schemes, especially for first-time buyers, can significantly reduce the financial burden and bring homeownership within reach.

“Finally, when you’re ready to finalise your purchase and transfer your deposit, don’t forget to purchase home insurance. Many banks require proof of home insurance before they will release mortgage funds, so having this in place is essential to ensure a smooth buying process.”

Sources and Methodology

To identify Ireland's most and least affordable counties for homebuyers, we analysed house sale prices across the country from 2010 to 2024. Using this data, we calculated the average house price in each county, along with the typical deposit required—assuming deposits are 10% of the purchase price.

We also examined mean salaries in each county for 2023 to estimate annual savings potential, assuming a national average savings rate of 12.7%. This allowed us to determine how many years it would take prospective buyers to save for a deposit.

Lastly, we forecasted house prices up to 2030 using current average prices (excluding VAT on new builds), providing a